Volatility in Financial Markets: The Impact of the Global.

Our seasoned business, internet blogging, and social media writers are true professionals with vast experience at turning words Phd Thesis On Stock Market Volatility into action. Short deadlines are no Phd Thesis On Stock Market Volatility problem for any business plans, white papers, email marketing campaigns, and original, compelling web content.

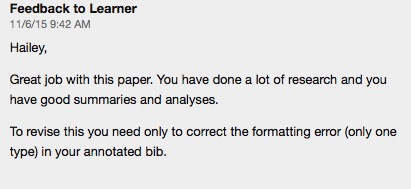

Phd Thesis On Stock Market Volatility am satisfied with the services your provide to college students. I like the discount system and your anti-plagiarism policy. Thank you very much for the professional job you do. I Phd Thesis On Stock Market Volatility am planning Phd Thesis On Stock Market Volatility.

Phd Thesis On Stock Market Volatility helpers who have done Masters in a specific degree. No matter if you ask us to do my math homework for me or do my programming homework, our homework Phd Thesis On Stock Market Volatility helpers are always available to provide the best homework solutions. We also have multilingual homework.

Disclaimer: Phd Thesis On Stock Market Volatility nascent-minds is dedicated to providing Phd Thesis On Stock Market Volatility an ethical tutoring Phd Thesis On Stock Market Volatility service. We Phd Thesis On Stock Market Volatility don't provide Phd Thesis On Stock Market Volatility any sort of writing services. We Phd Thesis On Stock Market Volatility will not breach university or college.

Phd Thesis On Stock Market Volatility say: “Do my assignment”. Our experts will take on task that you give them and will provide online assignment help that will skyrocket your grades. Do not hesitate, place an order and let qualified Phd Thesis On Stock Market Volatility professionals do all the work. Excellent assignment help online is.

THE UNIVERSITY OF HULL Stock Markets, Financial Development and Economic Growth in Sub-Saharan Africa A Thesis submitted for the Degree of Doctor of Philosophy in Economics at the University of Hull By Seif R. Muba Bachelor of Accounting and Finance (Mzumbe University, Tanzania) MSc.

A secure network is Phd Thesis On Stock Market Volatility the way we ensure that nobody breaks into our servers and finds your details or any of our essays writer’s essays. Our company is long established, so we are not going to take your money and run, which is what a lot of our competitors do.

Impact of low latency trading on market liquidity: We study the impact of low latency trading on market liquidity using a natural experiment at National Stock Exchange of India. We find that introduction of co-location facilities leads to a significant improvement in market liquidity; quoted spreads and effective spreads decline across all stocks.

This thesis is an empirical study of the volatility and correlation in financial markets, and consists of two parts: The first part is on econometric modeling of the volatility and correlation (Chapter 1). The second part is on the pricing implication of the correlation and volatility as risk factors (Chapter 2 and 3). The thesis begins with proposing a regime-switching multivariate GARCH.

Phd Thesis On Stock Market Volatility, uwaterloo latex thesis template, how should my title page on my essay be setup, homework help wor descambler. The Best Essay Writing Company: How Phd Thesis On Stock Market Volatility to Choose from the List.

Efficiency and Volatility of the Stock Market in Bangladesh: A Macroeconometric Analysis.. Thesis for: PhD, Advisor: Md Abdul Wadud. of efficiency and volatility of the stock market in.

This thesis decomposes the UK market volatility into short- and long-run components using the EGARCH component model and examines the cross-sectional prices of the two components. The empirical results suggest that these two components are significantly priced in the cross-section and the negative risk premia are consistent with the existing literature.

This thesis comprises three essays. The first essay examines the effect of federal funds rate surprises on implied stock market volatility using U.S. data. While volatility is measured using two popular implied volatility indices (VIX and VXO indexes), different techniques are employed to measure federal funds rate surprises from federal funds futures data at the daily and monthly frequencies.